Introduction

The idea of earning passive income through Trucking Automation Passive Income programs sounds exciting — who wouldn’t want to make money while they sleep? But with so many online promises and mixed reviews, it’s hard to tell what’s real and what’s just marketing. This article dives deep into Trucking Automation Passive Income Reviews, exploring how it works, the potential profits, and the risks you should know before investing.

What Is Trucking Automation Passive Income?

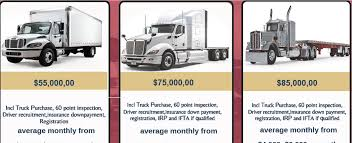

Trucking automation passive income refers to business models where investors or entrepreneurs use automation systems — such as AI fleet management, remote dispatch, and autonomous trucks — to generate income with minimal day-to-day involvement.

Essentially, you invest capital into a trucking company or automation platform that promises to handle everything from vehicle acquisition, driver scheduling, and logistics optimization to maintenance. The goal: create a “hands-off” source of income.

According to a 2024 Allied Market Research report, the global autonomous truck market is projected to hit $1.7 trillion by 2030, growing at a 15% CAGR. This growth fuels many passive income opportunities — but not all are legitimate or risk-free..

Read too: Franklin Truck Parts Near Me: Your Complete Guide to Local Truck Parts & Repair Solutions

How Does Trucking Automation Generate Passive Income?

Automation can create passive income through several models:

| Model Type | How It Works | Potential ROI | Risk Level |

|---|---|---|---|

| Fleet Ownership Programs | Investors buy trucks managed by a company | 10–25% annually | Moderate–High |

| Automation Software Licensing | Licensing AI dispatch or logistics software to fleets | 15–30% | Medium |

| Autonomous Truck Partnerships | Investing in autonomous freight routes | 8–20% | High |

| Logistics Automation Startups | Equity in emerging tech companies | Varies | Very High |

The idea is to leverage automation technology to reduce manual work, increase efficiency, and improve margins. However, “passive” doesn’t mean “risk-free.” Investors should research the management, fleet size, insurance coverage, and technology reliability before committing funds.

Are Trucking Automation Passive Income Programs Legit?

Here’s where most people search for Trucking Automation Passive Income Reviews — to verify legitimacy.

The truth? Some are legitimate logistics investments, but many others are overhyped schemes marketed as “fully automated passive income.” The Federal Motor Carrier Safety Administration (FMCSA) emphasizes that trucking remains heavily regulated and human-dependent, even with automation.

Red flags to watch for:

- Unrealistic ROI promises (50%+ per year)

- No verifiable business registration or DOT number

- Lack of transparent ownership or contact information

- No real trucks or contracts visible to investors

Always verify a company’s DOT record via Wikipedia’s FMCSA page or official government databases before investing.

Benefits and Drawbacks of Trucking Automation Investments

Here’s a quick overview to help evaluate your decision:

Pros:

- Potential for high ROI in a growing logistics market

- Minimal daily management required

- Leverages cutting-edge AI and automation technology

- Passive scaling opportunities through fleet expansion

Cons:

- High entry costs (often $100K+ for fleet participation)

- Market volatility due to fuel, regulation, and freight demand

- Technological reliability and maintenance risks

- Many scams or unregulated investment programs

Verdict: Great potential, but only when partnered with transparent, licensed, and established operators.

Case Study: Real-World Example of Automated Trucking Success

One credible example is Embark Trucks, a U.S. automation company that successfully tested driverless freight routes across Texas and Arizona. Their automation systems reduced labor costs by 30% and increased route efficiency by 12%.

However, even Embark’s investors had to wait several years for consistent profitability. It’s a long-term play — not a get-rich-quick scheme.

How to Evaluate Trucking Automation Opportunities (Step-by-Step)

- Research the Company: Check DOT registration, Better Business Bureau rating, and founder credibility.

- Ask for Proof of Assets: Verify truck ownership or leasing agreements.

- Review Income Models: Understand exactly how profits are generated (not just “AI automation”).

- Check Legal Compliance: Ensure FMCSA licensing and insurance coverage.

- Start Small: Test with a smaller investment before scaling up.

Top Alternatives to Trucking Automation Passive Income

If you’re intrigued by automation but want lower risk, consider:

- Fleet leasing programs with established logistics firms.

- REITs in transportation infrastructure for consistent dividends.

- AI logistics startups via crowdfunding platforms.

- Traditional trucking business ownership with professional management.

These may deliver semi-passive income with better control and transparency.

FAQ – Trucking Automation Passive Income Reviews

1. Is trucking automation really passive?

Not fully. While automation reduces active management, investors still need oversight and financial tracking to ensure profitability.

2. How much can you earn from automated trucking?

Typical returns range from 8% to 25% annually, depending on fleet performance and contract stability. Beware of any promise above 40% — that’s unrealistic.

3. Are there scams in this industry?

Yes. The growth of AI and logistics automation has attracted fraudulent operators. Always verify business registration and financial documentation.

4. Do autonomous trucks replace human drivers?

Not yet. Current technology still requires safety drivers and dispatch supervisors. Full autonomy is expected later this decade.

5. Can beginners invest in trucking automation?

Yes, but start small and seek expert financial advice. Many platforms offer managed investment options for first-time participants.

Conclusion

Trucking Automation Passive Income Reviews reveal a mix of promise and caution. The concept is real — automation is reshaping logistics and freight transport — but not every opportunity is trustworthy. Approach these investments like any other business venture: research deeply, verify credentials, and manage expectations.

Leave a Reply