Many truck owners and owner-operators work hard every mile but still feel unsure whether they are truly profitable. A Trucking Profit And Loss Statement Template helps you clearly see where your money comes from, where it goes, and how much you actually keep. In this guide, you’ll learn how to build, understand, and use a trucking P&L statement—step by step—even if you’re not an accounting expert.

What Is a Trucking Profit And Loss Statement?

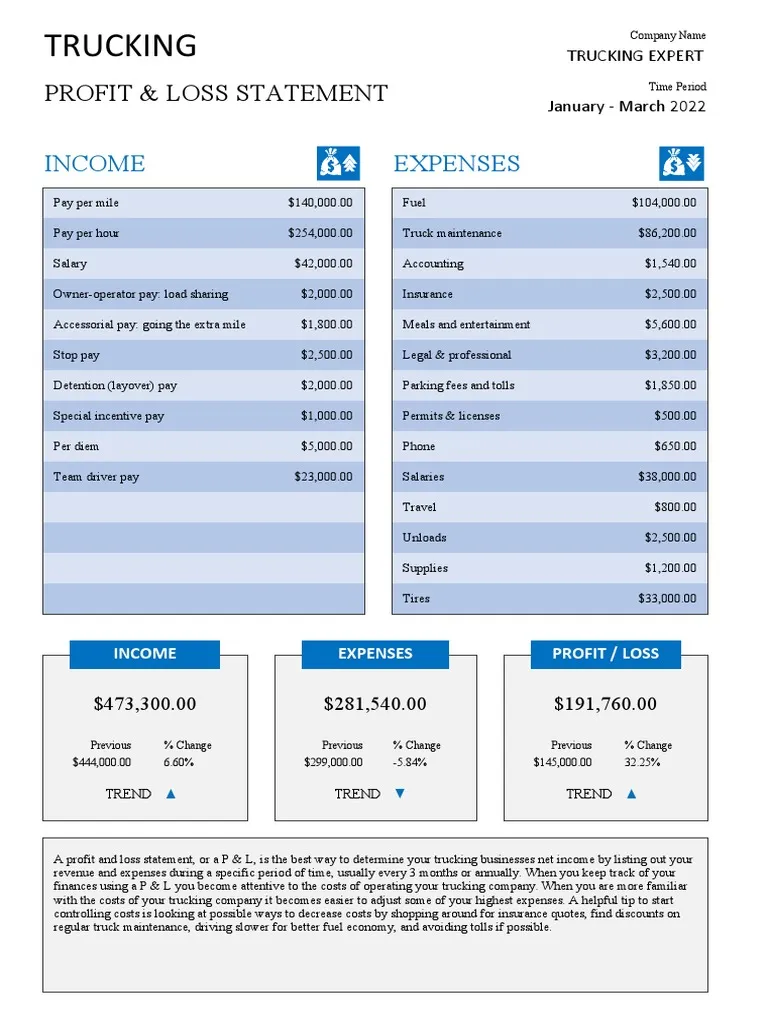

A Profit and Loss (P&L) statement is a financial report that summarizes your trucking business income, expenses, and net profit over a specific period (monthly, quarterly, or yearly).

Read too: Franklin Truck Parts Near Me: Your Complete Guide to Local Truck Parts & Repair Solutions

In simple terms, it answers one key question:

“Am I making money—or just staying busy?”

For trucking businesses, a P&L statement is especially important because operating costs like fuel, maintenance, and insurance can quickly eat into revenue.

For a general definition of profit and loss statements, see this reference:

👉 https://en.wikipedia.org/wiki/Income_statement

Why Every Trucking Business Needs a P&L Statement

Whether you’re an owner-operator or managing a small fleet, tracking profit is not optional—it’s essential.

Key benefits of using a trucking P&L:

- Understand true profitability per mile

- Identify high or unnecessary expenses

- Prepare for tax season with less stress

- Support loan or equipment financing

- Make smarter pricing and load decisions

📊 Industry insight: Many owner-operators who “feel broke” are actually profitable—but lack clear financial tracking to prove it.

What Makes a Trucking P&L Different From Other Businesses?

Trucking has unique cost structures that standard templates often miss.

Trucking-specific factors include:

- Fuel cost volatility

- Maintenance and breakdown risk

- Per-mile vs per-load income

- Driver-related costs (if applicable)

That’s why using a Trucking Profit And Loss Statement Template tailored to the industry matters.

Core Sections of a Trucking Profit And Loss Statement

A proper trucking P&L has four main sections.

1. Revenue (Income Section)

This is the money your trucking business earns.

Common revenue categories:

- Line haul revenue

- Fuel surcharge

- Detention pay

- Layover pay

- Accessorial charges

💡 Tip: Always track gross revenue before deductions.

2. Cost of Operations (Direct Costs)

These are expenses directly tied to running the truck.

Typical trucking direct costs:

- Fuel

- Maintenance & repairs

- Tires

- Tolls & scales

- Truck wash

📌 Fuel alone often accounts for 25–35% of total operating costs.

3. Operating Expenses (Overhead)

These costs exist whether you drive or not.

Common overhead expenses:

- Insurance (liability, cargo, physical damage)

- Truck payment or lease

- Permits and plates

- Dispatch or factoring fees

- Accounting and legal services

4. Net Profit (The Bottom Line)

This is the number that matters most.

Formula:

Net Profit = Total Revenue – Total Expenses

If this number is negative, your business is operating at a loss—even if cash flow feels okay.

Trucking Profit And Loss Statement Template (Simple Example)

Below is a text-based P&L template you can adapt to Excel, Google Sheets, or accounting software.

Monthly Trucking P&L Template (Example)

| Category | Amount ($) |

|---|---|

| Revenue | |

| Line Haul | 18,000 |

| Fuel Surcharge | 3,200 |

| Total Revenue | 21,200 |

| Direct Costs | |

| Fuel | 6,500 |

| Maintenance & Repairs | 1,200 |

| Tolls & Scales | 300 |

| Total Direct Costs | 8,000 |

| Operating Expenses | |

| Truck Payment | 2,100 |

| Insurance | 1,400 |

| Permits & Licenses | 250 |

| Accounting | 150 |

| Total Operating Expenses | 4,000 |

| Net Profit | 9,200 |

📈 This example shows a healthy operation—but real numbers vary widely.

How to Create a Trucking Profit And Loss Statement (Step-by-Step)

Step 1: Choose a Time Period

Most truckers use:

- Monthly P&L (recommended)

- Quarterly summaries

- Annual reports (for taxes)

Step 2: Track Every Dollar of Income

Use:

- Load confirmations

- Settlement statements

- Bank deposits

Be precise—small fees add up.

Step 3: Categorize Expenses Properly

Separate:

- Direct truck costs

- Business overhead

- Personal expenses (never mix!)

⚠️ Mixing personal and business expenses is a common and costly mistake.

Step 4: Calculate Cost Per Mile (CPM)

This metric is critical.

Formula:

Total Expenses ÷ Total Miles Driven

💡 Knowing your CPM helps you avoid accepting unprofitable loads.

Step 5: Review and Adjust Monthly

Ask:

- Which expenses increased?

- Did revenue per mile improve?

- Where can costs be reduced?

Trucking P&L vs Cash Flow: Why Both Matter

Many truckers confuse profit with cash flow.

Key difference:

- Profit: Long-term business health

- Cash flow: Short-term bill-paying ability

You can be profitable and still struggle with cash flow due to:

- Slow broker payments

- High upfront fuel costs

Using a P&L alongside cash flow tracking gives a complete picture.

Common Trucking Expenses People Forget to Include

Missing expenses make profit look better than it really is.

Often overlooked costs:

- Breakdown reserves

- Health insurance

- Self-employment taxes

- Per diem adjustments

- Depreciation

🧠 Expert insight: Underestimating expenses is one of the top reasons trucking businesses fail within the first 3 years.

Owner-Operator vs Fleet P&L Statements

Owner-Operator

- Simpler structure

- Focus on per-mile profit

- Heavy fuel and maintenance tracking

Small Fleet

- Multiple trucks

- Driver wages

- Payroll taxes

- Higher insurance complexity

Your Trucking Profit And Loss Statement Template should match your operation size.

How a P&L Helps With Taxes and Compliance

A clean P&L simplifies:

- Quarterly tax estimates

- Annual tax filing

- Audits and documentation

Many accountants recommend updating your P&L monthly to avoid year-end stress.

Tools to Use With Your Trucking P&L Template

You don’t need expensive software to start.

Popular options:

- Excel or Google Sheets

- Entry-level accounting software

- Spreadsheet templates customized for trucking

📌 Start simple—accuracy matters more than fancy tools.

Signs Your Trucking Business Is Profitable (According to Your P&L)

Look for these indicators:

- Consistent positive net profit

- Stable or decreasing cost per mile

- Fuel cost under control

- Maintenance reserves growing

If your P&L shows shrinking profit margins, it’s time to adjust rates or costs.

FAQ: Trucking Profit And Loss Statement Template

How often should I update my trucking P&L?

Monthly updates are ideal for accurate tracking and decision-making.

Is a P&L required for owner-operators?

Not legally required, but strongly recommended for business success.

Can I use a generic P&L template?

You can, but trucking-specific templates provide better insight.

What’s a good profit margin in trucking?

Net margins of 10–20% are generally considered healthy.

Should I hire an accountant?

Yes—especially as your operation grows or taxes become complex.

Conclusion

A Trucking Profit And Loss Statement Template is more than paperwork—it’s a roadmap for smarter decisions, higher profits, and long-term stability. When you understand your numbers, you control your business instead of guessing.

If this guide helped you, share it on social media with fellow truckers or owner-operators. One clear P&L can be the difference between surviving and truly succeeding in the trucking industry. 🚛📊

Leave a Reply