Introduction

Running a trucking business is more than just keeping your wheels on the road—it’s about keeping your finances in check. Many owner-operators and small fleet owners struggle with tracking expenses, revenue, and profit margins. That’s where a Trucking Profit And Loss Spreadsheet comes in handy. This simple but powerful tool helps you see where your money is going, make smarter financial decisions, and ultimately keep your business profitable.

What Is a Trucking Profit And Loss Spreadsheet?

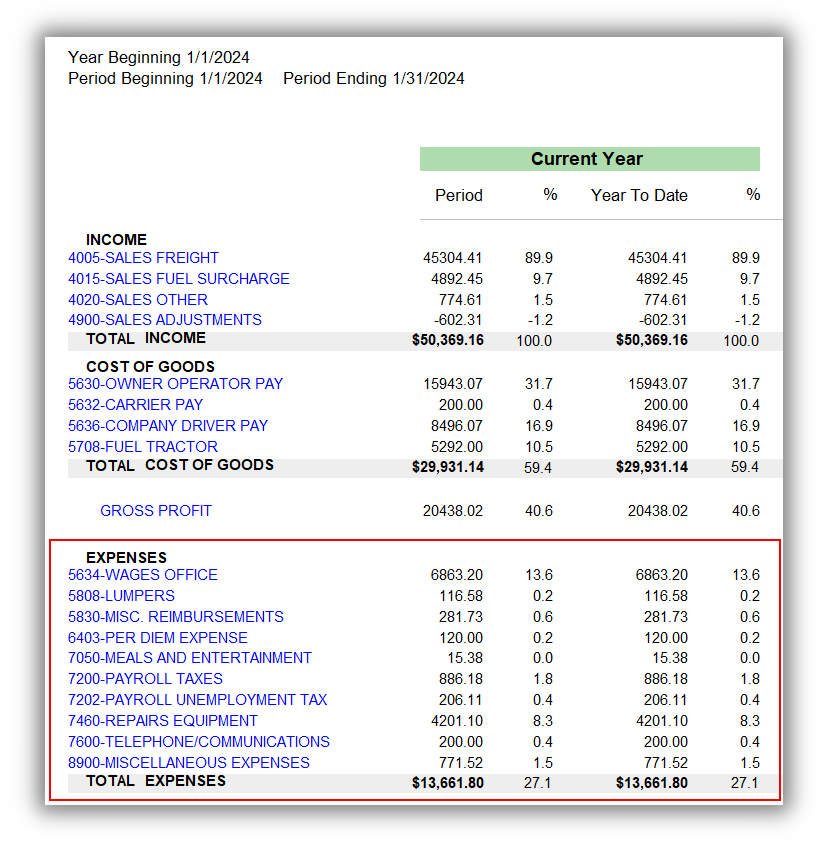

A trucking profit and loss (P&L) spreadsheet is a financial document designed to track income, expenses, and net profit for trucking companies or independent truck drivers.

Read too: Franklin Truck Parts Near Me: Your Complete Guide to Local Truck Parts & Repair Solutions

It typically includes:

- Revenue (freight income, fuel surcharge, accessorial charges)

- Fixed expenses (truck payments, insurance, permits)

- Variable expenses (fuel, maintenance, tolls)

- Net income (revenue – expenses)

Unlike generic accounting spreadsheets, this one is tailored to the trucking industry, making it easier to monitor the unique costs and revenue streams truckers deal with daily.

Why Do Truckers Need a Profit And Loss Spreadsheet?

Truckers often deal with tight margins—sometimes profit can be less than 10% of revenue (American Trucking Associations, 2023). Without clear records, it’s easy to overspend on fuel or underestimate maintenance costs.

A P&L spreadsheet helps you:

- Understand true profitability per mile.

- Prepare for tax season with accurate records.

- Control costs by spotting spending patterns.

- Build credibility when applying for loans or fleet financing.

Think of it as your financial dashboard: you wouldn’t drive without a GPS, so why run your business without a P&L spreadsheet?

How To Set Up a Trucking Profit And Loss Spreadsheet

Creating one doesn’t require advanced accounting knowledge. Here’s a simple step-by-step guide:

- Choose a Platform

- Excel, Google Sheets, or accounting software (like QuickBooks).

- Google Sheets is best for accessibility and real-time updates.

- Create Income Categories

- Line haul revenue

- Fuel surcharge

- Detention or layover pay

- List Expense Categories

- Fuel

- Truck payment

- Maintenance & repairs

- Insurance

- Licenses & permits

- Tolls & scales

- Miscellaneous (meals, parking, office supplies)

- Add Columns for Each Month

- January through December

- Include a Year-to-Date (YTD) total column

- Insert Simple Formulas

- Example:

=SUM(B2:B12)to calculate total monthly expenses - Example:

=Revenue - Expensesto calculate profit

- Example:

- Review Monthly

- Compare month-over-month to catch rising costs early.

Example: Profit And Loss Breakdown

| Category | January | February | March | YTD Total |

|---|---|---|---|---|

| Revenue | $18,000 | $19,200 | $17,500 | $54,700 |

| Fuel | $6,200 | $6,500 | $6,000 | $18,700 |

| Truck Payment | $2,000 | $2,000 | $2,000 | $6,000 |

| Insurance | $1,200 | $1,200 | $1,200 | $3,600 |

| Maintenance | $800 | $1,500 | $600 | $2,900 |

| Misc. Expenses | $400 | $450 | $500 | $1,350 |

| Total Expenses | $10,600 | $11,650 | $10,300 | $32,550 |

| Net Profit | $7,400 | $7,550 | $7,200 | $22,150 |

This breakdown shows at a glance how much money is left after covering expenses.

Benefits vs. Limitations

Benefits:

- Easy to customize.

- Low cost (just need Excel or Google Sheets).

- Helps track cash flow without complex software.

Limitations:

- Manual data entry (time-consuming).

- Human error risk if not double-checked.

- May lack advanced insights that software provides.

If you’re just starting, a spreadsheet is perfect. As your fleet grows, you may want to transition to trucking-specific software.

Best Practices for Using a Trucking P&L Spreadsheet

- Log expenses daily: Don’t wait until month-end.

- Save receipts: For IRS audits and tax deductions.

- Review per mile cost: Divide total expenses by miles driven.

- Back up your file: Cloud storage is safer than relying only on a laptop.

- Compare with industry averages: For example, according to Wikipedia, fuel often represents the largest operating cost in U.S. trucking—usually 20–40%.

FAQ: Trucking Profit And Loss Spreadsheet

1. What’s the difference between a trucking P&L spreadsheet and regular accounting software?

A spreadsheet is manual but highly customizable, while software like QuickBooks automates entries, integrates with bank accounts, and offers advanced reports.

2. How often should I update my P&L spreadsheet?

Ideally daily, but weekly works if you keep receipts and records organized. Monthly updates risk missing important cost fluctuations.

3. Can I use a trucking P&L spreadsheet for taxes?

Yes. It provides a clear summary of income and deductible expenses, but you should still consult a tax professional to ensure compliance.

4. What’s the best format: Excel or Google Sheets?

Both work well. Excel is great offline, while Google Sheets allows sharing and updating on the go.

5. Do small trucking businesses really need a P&L spreadsheet?

Absolutely. Even one-truck owner-operators benefit from understanding whether their runs are profitable after expenses.

6. Is there a free trucking P&L template?

Yes, many templates are available online. You can start with a free version and customize categories for your business.

Conclusion

A Trucking Profit And Loss Spreadsheet is one of the most practical tools a trucking business can use to stay financially healthy. It gives you clarity, keeps expenses under control, and helps maximize profits.

If you found this guide useful, share it with fellow truckers or fleet owners—help others take control of their business finances!

Leave a Reply